#Lease residual value driver

InsuranceĬomprehensive Insurance is factored in to the monthly rental and assumes the driver is Rating 1. A dollar figure is calculated per kilometre nominated. The maintenance estimate is generated on the category of the nominated vehicle. The cost of fuel per litre is a speculated average over the term of the lease, and considers the following factors: The Statutory Rate used in all calculations is 20%, regardless of distance nominated.

#Lease residual value registration

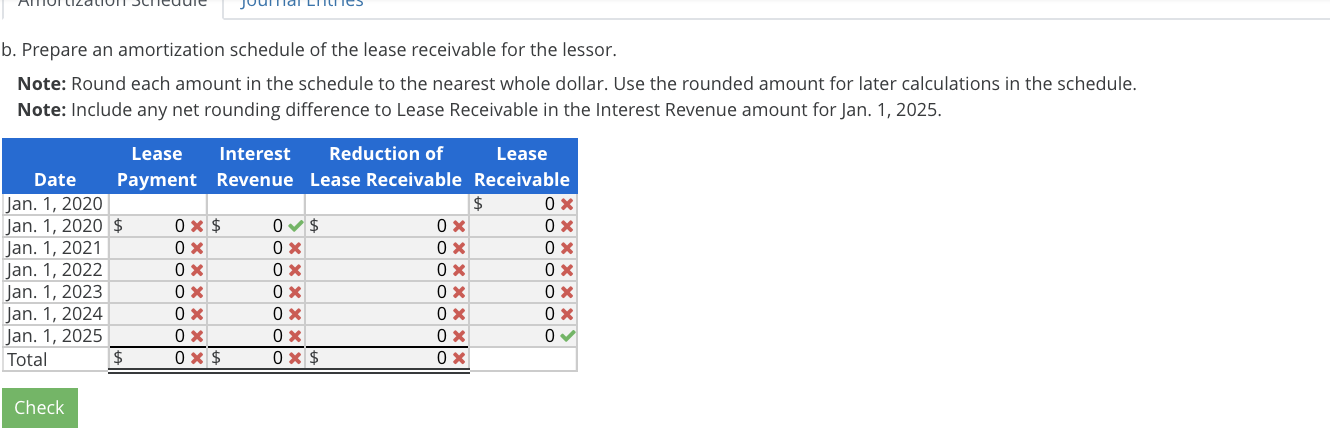

The financed amount is the list price of the nominated vehicle (excluding GST), including Stamp Duty, LCT, registration and CTP insurance. The Residual Value is your novated lease payout figure at the end of your lease agreement and is inclusive of GST. This value is set by the ATO as follows ġ Year term, has a residual value of 65.63% of the amount financed. At the end of the nominated lease term there is a Residual Value. Is defined by the number of months nominated. Gross Annual Incomeįigure entered treated as Gross salary - excluding superannuation or any other salary packaging deductions or HECS liability. Assumptions Annual Kilometresįigure entered treated as 100% personal use. The rental figures and projected savings are indicative only and do not constitute a quote or offer of finance. The Novated Lease Calculator is indicative only, designed to provide a reasonable estimate of the monthly rental costs and savings associated with leasing a vehicle. See the Knowledge Base in the Resource Center.To enter into a Novated Lease with LeasePlan, your employer will need to have a business relationship with LeasePlan. The present value of the sum of the lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments in accordance with paragraph 842-10-30-5(f) equals or exceeds substantially all of the fair value of the underlying asset. The NPV of the lease payments and guaranteed residual value of 0.00% is not 90% or greater of the Fair Value of the asset. Test #4 of the Classification Tests is as follows: PV of Amount Not Reflected in Payments: This amount is added to the classification test #4. Unguaranteed Residual Value: Equals the Estimated Residual value less the Residual Value Guarantee.Īmount Not Reflected in PV of Payments: Equals less less. Must be between zero and the total payment amount.Īmount Probable of Being Owed by Lessee: Equals the RV Guarantee less Guaranteed amount reflected in payments. Guaranteed Amount Reflected in Payments: Enter the guaranteed amount already reflected in payments. RV Guaranteed by Lessee: The amount at risk by the lessee. Lessor Explicitly Exempts Lessee: If yes, the RV guaranteed amount by a 3rd party will reduce the amount probable of being owed by the lessee. RV Guaranteed by 3rd Party: Residual Value guaranteed by a 3rd party, such as an insurance company, must be between zero and the residual value guaranteed. Value must be greater than or equal to zero. RV Guaranteed: A guarantee made to a lessor that the value of the asset returned to the lessor at the end of a lease will be at least a specified amount. The value must be greater than or equal to zero. Completing this section is optional.Įstimated Residual Value: The estimated fair value of the leased property at the end of the lease term. The Residual value section is displayed when you select an applicable Classification type, such as Operating 842, Finance 842, and IFRS 16. This usage primarily applies to equipment leases rather than real estate leases. The Residual Value section of the Add Schedule and Edit Schedule pages allows you to capture information related to the Residual Value guarantees.

0 kommentar(er)

0 kommentar(er)